-

Recurring billing is a payment model used when a subscription business charges a customer's credit card for products or services on a regular billing schedule. Subscription services tend to charge this on a monthly or annual schedule, until the customer withdraws permission or cancels their subscription.The use of recurring billing software for insurance companies offers steady cash flow and savings on staff and resources. There are many advantages of using recurring billing such as security, reduction in management costs and increased efficiency.

Healthcare Reporting

-

Predictable revenue which simplifies decision makings

-

reduction in management costs.

-

Increases efficiency.

Advantages of recurring billing

-

-

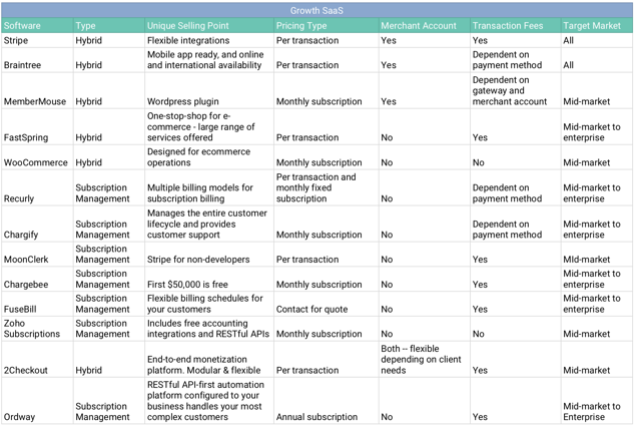

hybrid -- payment gateways that have a subscription layer.

Subscriptions/Recurring billing management systems

-

Invest in educating members on how to improve their health.

-

Be informed of the costs incurred/likely to be incurred.Claims, commissions, management expenses.

-

Cost strategy characteristics in the insurance company.

-

Cost strategy Basic objective Instruments used Main problem areas - Reduction-based cost strategy/cost optimization

- Target cost level

- Cost budgeting

- Activity-based management

- Responsibility accounting

- Acquisition costs

- Loss adjustment expenses

- Administrative costs

- Activity-based costs

- Internal units cost

- Investment management costs

- Cost strategy based on pricing policy

- Target premium rate

- Product life cycle costing.

- Kaizen costing.

- Client’s cost accounting.

- Product profitability

- Client profitability

- Distribution channels profitability

- Profitability of reinsurance technical activities

- Investment profitability

- Investment management costs

- Profitability- based cost strategy

- Target profitability level

- Budgeting and control of claims incurred costs

- Claims incurred

- Insurance risk- based cost strategy

- Target level of insured risk

- Budgeting and control of claims incurred costs coordinated with a defined solvency level

- Claims incurred

- Solvency

- Own funds

- Capital

- Cost volatility

- Cost strategy based on financial liquidit

- Target financial liquidity level

- Cash flow statement

- Cost budgeting coordinated with cash flow budgeting

- Value creation chain

- Costs expenses relation

- Cash flow

- Defining the relation between cost raising and cash flow generating

- Value creation in the insurance company

- Cost strategy based on cost of capital minimization

- Minimum weighted average cost of capital

- Capital budgeting

- Financial leverage

- Capital structure

- Cost of capital